Your Credit. Your Power.

We believe that your credit score is the “superpower” that can help you achieve financial success. That's why we offer our members access to Savvy Money—a comprehensive, user-friendly tool for managing money and building wealth over time.

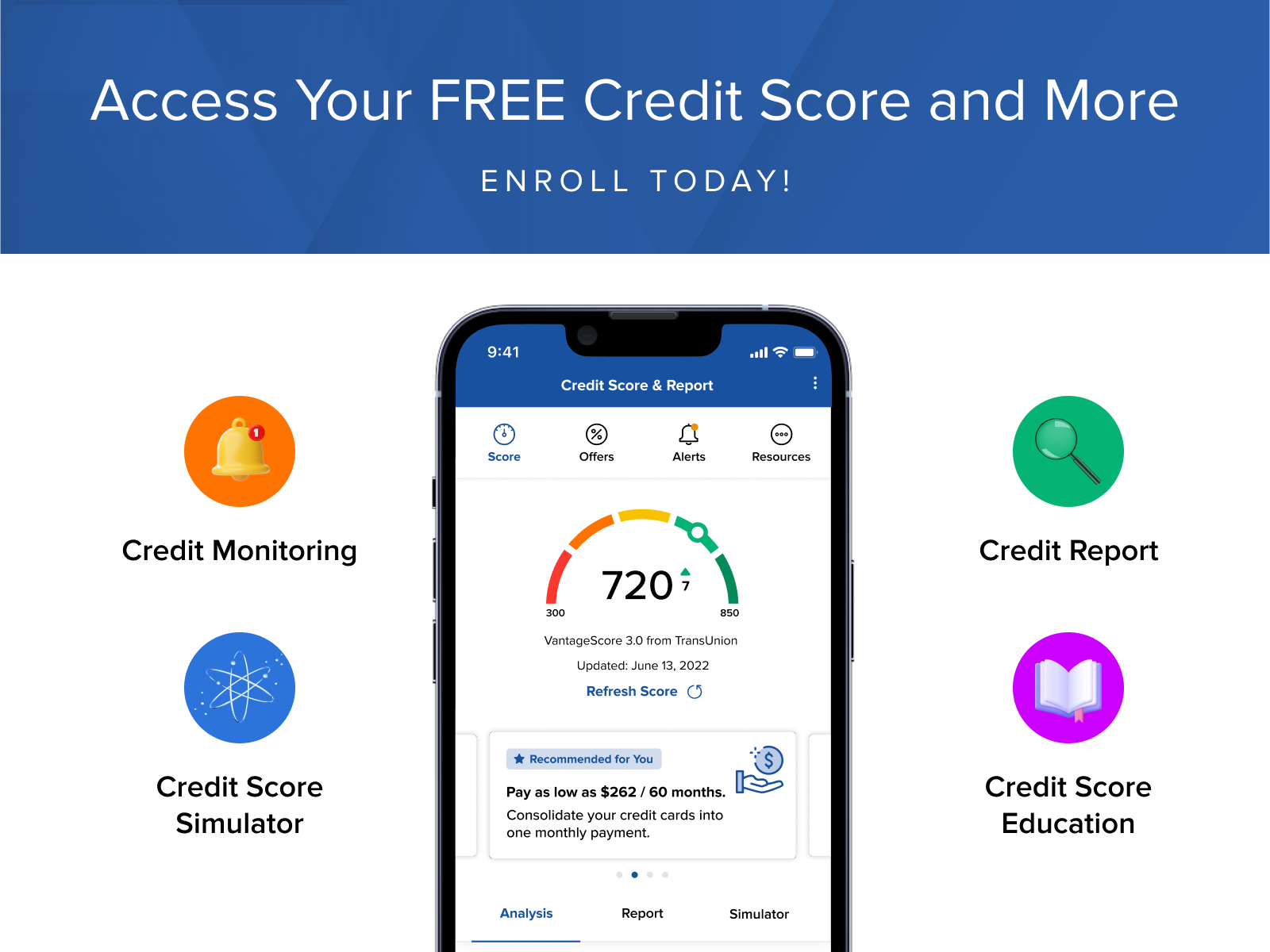

Understanding the factors contributing to your three-digit credit score is essential, and Savvy Money provides you with the tools to do just that, conveniently located within our mobile app and online banking. By knowing what goes into calculating your credit score, you can make informed decisions to maintain a healthy credit score and make the best financial choices.

The best part? Savvy Money is FREE for all AlaTrust members, and you can check and refresh your credit score and credit report every day without any negative impact on your score.

It is ALL in Credit Score.

- Personalized Credit Report

- Real-Time Credit Monitoring Alerts

- Credit Goals and Action Plan

- Credit Score Simulator

- Credit Score Education

- And More!

Are you ready to reach your financial goals? Enroll in Savvy Money today by logging into Online/ Mobile banking and click the "View your credit score and report" link.

Get Started Today!